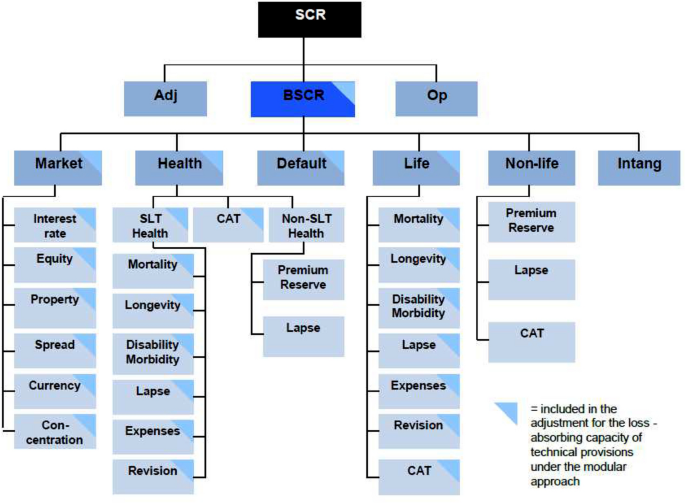

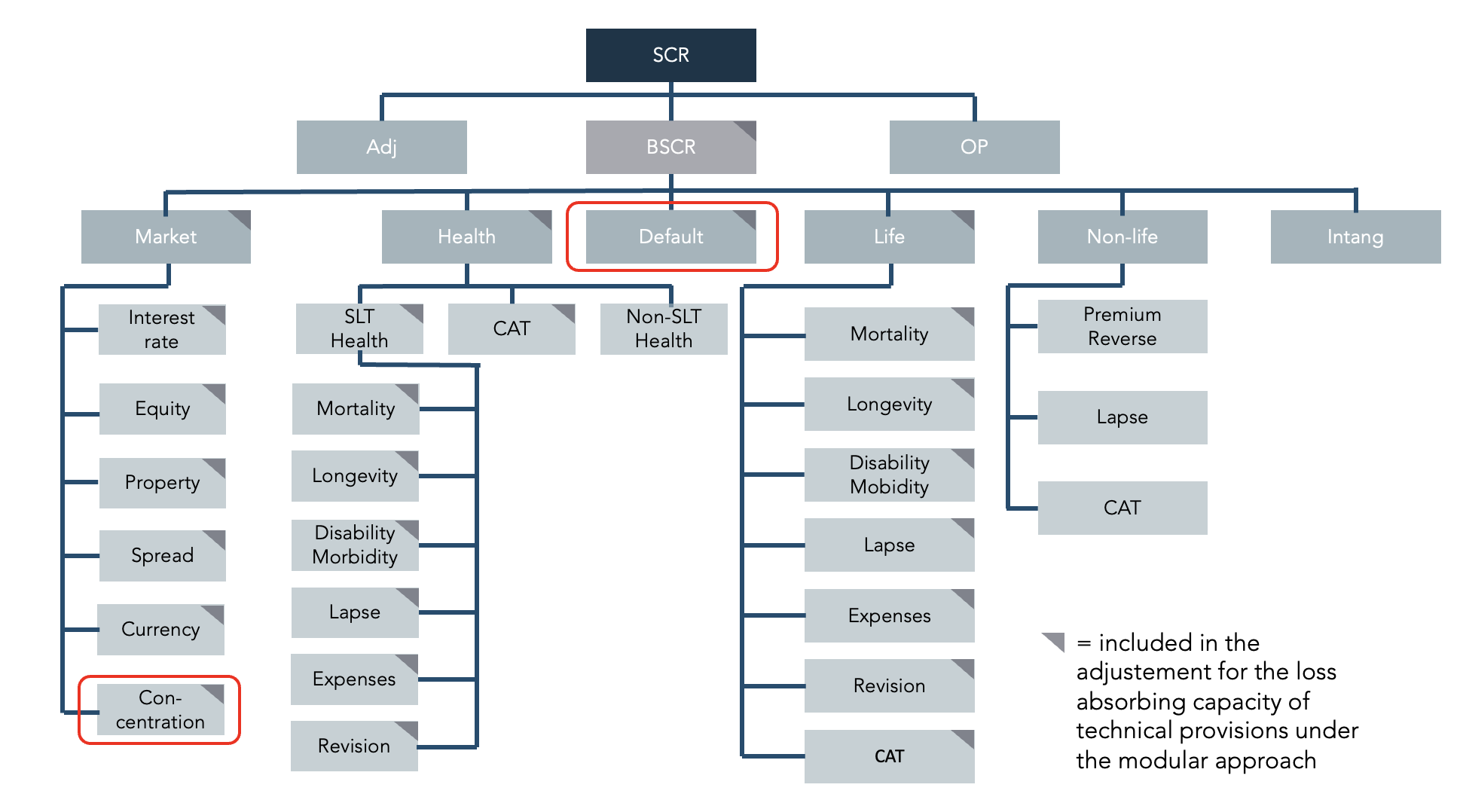

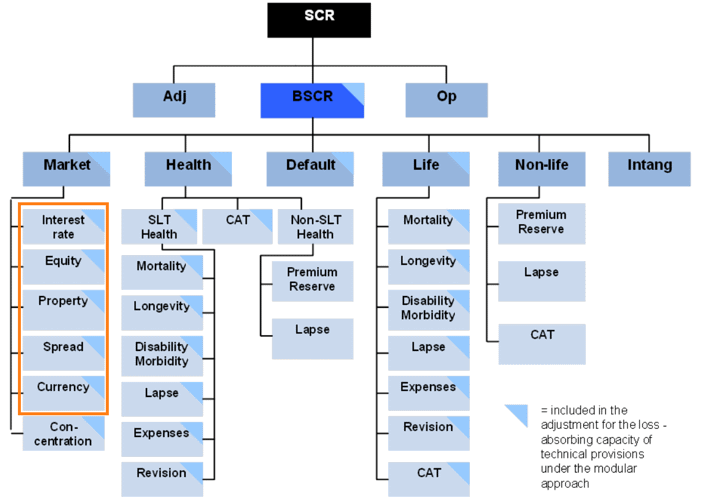

Solvency II Standard Formula Structure Source: European Insurance and... | Download Scientific Diagram

An Analysis of Solvency II Standard Formula for Calculation of SCR , possible corrections and a comparison with an internal model | Semantic Scholar

Solvency II. A comparison of the standard model with internal models to calculate the Solvency Capital Requirements (SCR) - GRIN

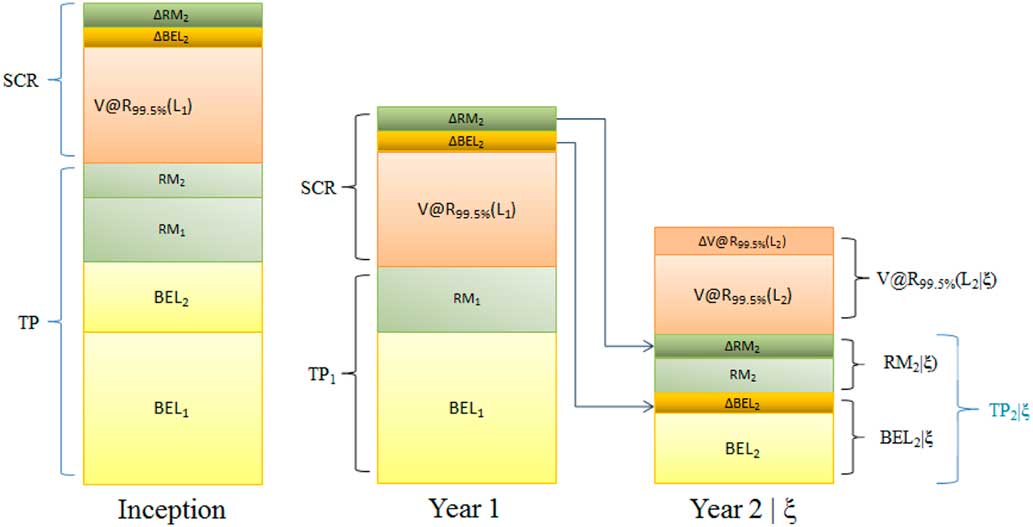

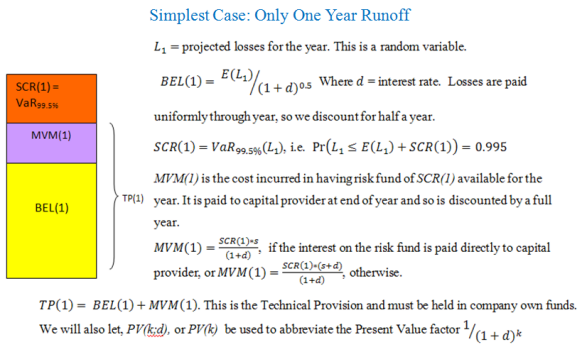

Solvency capital requirement and the claims development result D. Munroe*, B. Zehnwirth and I. Goldenberg

Quantifying credit and market risk under Solvency II: Standard approach versus internal model - ScienceDirect